Actionable insights from canceling customers

Limiting churn is critical to scaling a SaaS business. Most SaaS companies survey customers that cancel to gain further insight, but they often end up with high-level, non-actionable insights such as “40% of customers cancel because the price is too high” or “15% of customers cancel because they found the product confusing”.

The most helpful cancelation surveys follow three basic principles:

Keep it short and simple to drive as high participation as possible

Include at least one free-text answer because your customers may tell you something you were not aware of

Do not make the survey anonymous so you can tie the customer response to how the product was used

The third principle is frequently missed, but critical to get actionable insights. Below, I’ll share three examples of how an understanding of product engagement combined with the cancelation survey can yield powerful insights

For the customers where product is ‘too expensive’ or provide ‘too little value’

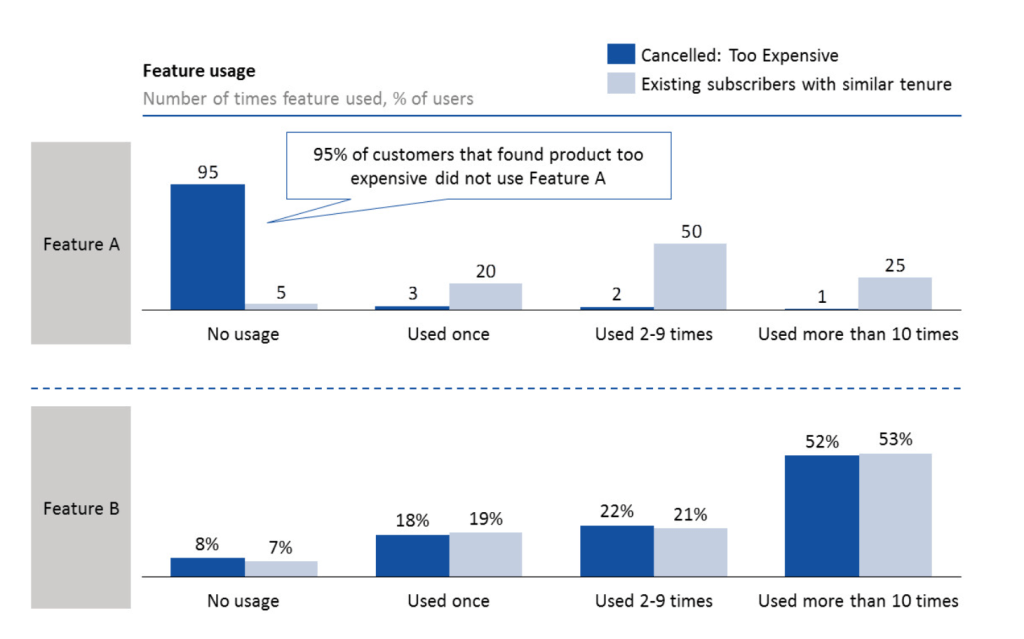

Some customers will state that they canceled because the product was too expensive. Without the ability to identify the cohort, you will not be able to price discriminate (beyond using the cancelation as a signal). More importantly, price may not be the true underlying issue – perhaps your customers did not discover and use the features that are worth paying for:

In the chart above, we see that customers that indicated the product was too expensive did not find and use ‘feature A’. If you believe the ‘feature A’ is important for willingness to pay, you could invest in making the feature more discoverable rather than lowering the price. Alternatively, you could create a product option without feature A marketed to this cohort at a lower price point.

For the customers where the product ‘didn’t meet expectations’

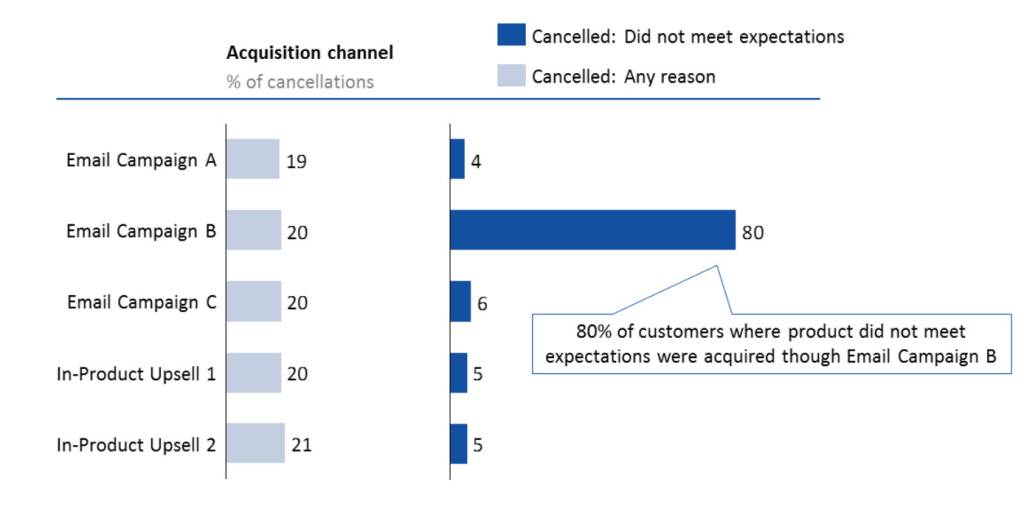

Some customers will state that they canceled because the product did not meet expectations. A natural follow-up question is if this cohort had expectations set differently. For example, you could look at the acquisition channel of customers that churned:

In the chart above, we see that customers with misaligned expectations primarily came through ‘Email Campaign B’. Instead of making broad improvements, we can focus on ensuring messaging and flow of ‘Email Campaign B’’ is in line with other channels.

For the customers where the product ‘was confusing’

Some customers will state that they canceled because the product was too confusing. Without additional information you could invest in support materials or a more extensive onboarding flow. However, the confused cohort may have taken a specific path through your product that is broken or confusing:

In the chart above, we see the majority of confused customers went to Feature C in their first session as opposed to feature A and B from the main page. This understanding allows us to focus on the specific flow from the main page to Feature C to identify any potential issues.

The examples above are by no means comprehensive, but they serve as an illustration that the cancelation survey results are often only the beginning of a string of subsequent questions and learnings that can only be possible if you know the trifecta of the ‘why’ from the survey, ‘who’ the survey taker is and ‘how’ she used your product.